“We care about you!” is a philosophy we live by in each interaction with our clients.

We care about the community we live in and the people we serve.

Call today to experience the Elkin Insurance difference for yourself.

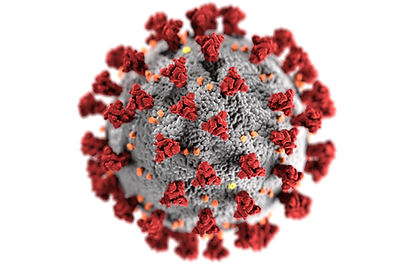

LONG COVID

A recent study from the Centers for Disease Control and Prevention (CDC) found that as many as 1 in 5 adults under the age of 65 who had COVID-19 experienced symptoms that could be considered long COVID. The phenomenon is even more common in older adults: 1 in 4 individuals 65 and older developed at least one health condition that may be attributable to a previous coronavirus infection. And research published in the journal The BMJ found that about 32 percent of older adults who survived COVID-19 sought medical attention in the months that followed their infection for new or persistent symptoms. It’s estimated that long COVID has affected as many as 23 million Americans, according to a March report from the U.S. Government Accountability Office. And a recent report says 4 million Americans have left the workforce due to Long Covid.

What Should You Do If You Suspect You Have Long Covid

1. KEEP AN EYE OUT FOR SYMPTOMS THAT NEED IMMEDIATE MEDICAL ATTENTION.

If symptoms like exhaustion or brain fog — and there are many others that fit into the definition of long COVID — continue or crop up after a COVID-19 infection, you’ll want to get them checked out.

2. MAKE AN APPOINTMENT WITH YOUR PRIMARY CARE PHYSICIAN.

Curious as to whom you should see when it comes to long COVID concerns? A good place to start is your primary care physician — preferably someone who knows your medical history and who can help determine if your symptoms are due to COVID-19 or something else entirely.

3. PREPARE FOR YOUR APPOINTMENT.

When you first meet with your doctor, it’s important to come prepared — this can make “all the difference” when it comes to getting the proper evaluation, diagnosis and treatment, the CDC says. Before your appointment, be sure to write down when you first tested positive for COVID-19 and when the symptoms that are still bothering you first started. Also note how often these symptoms occur and anything that makes them worse.

4. DON'T EXPECT IMMEDIATE RECOVERY.

Many patients with long COVID can be managed directly by their primary care physician, often with the aid of specialists like physical and occupational therapists to help rebuild strength and recoup lost skills. Your doctor may also refer you to an interdisciplinary Post-COVID Care Center (PCCC) — nearly every state has one.

Know the Symptoms of Long COVID

Symptoms can vary widely, but among the most common are:

-

Fatigue

-

Symptoms that get worse after physical or mental effort

-

Fever

-

Difficulty breathing or shortness of breath

-

Cough

-

Chest pain

-

Heart palpitations

-

Difficulty thinking or concentrating (sometimes referred to as “brain fog”)

-

Headache

-

Sleep problems

-

Dizziness/ lightheadedness

-

Pins-and-needles feelings

-

Change in smell or taste

-

Depression or anxiety

-

Diarrhea

-

Stomach pain

-

Joint or muscle pain

-

Rash

-

Changes in menstrual cycles

Source: CDC

WHO’S MOST AT RISK FOR LONG COVID?

Anyone can wind up with long COVID, including children, but research suggests that some people may be more prone to the condition, including:

-

People who experienced a more severe case of COVID-19, especially those who were hospitalized or needed intensive care.

-

People who had underlying health conditions before catching COVID-19.

-

People who are unvaccinated against COVID-19. (Studies suggest that people who are vaccinated but experience a breakthrough infection are less likely to report long COVID symptoms.)

Source: CDC